If you want to manage the currency of your online Shopify store easily, Shopify balance will be a good choice for your business. You can release yourself from paperwork when using a traditional method which is via a bank. Besides, you can easily manage all your business and money in one place. Sounds very interesting. Then if you want to integrate it in your store, let’s read our topic.

First, you should know what Shopify Balance is

You can control all of your shop’s payment transactions with Shopify Balance, an all-in-one money management account. Besides, you won’t waste monthly fees and receive payment quicker than a bank. You can get partner deals and receive cashback if you utilize the Shopify Balance card.

It integrates with the Shopify ecommerce platform to improve your company’s finances and to create a single dashboard with the checkout builder, order management, and Shopify Balance account. You have the ability to log into your account which is the same account credentials you apply for your Shopify store, just like Shopify’s many other products.

Additionally, Shopify business owners have an approach to an ATM, a business card with no minimum balance requirement, and a direct link to Shopify Capital in the event that they require financing for their enterprise.

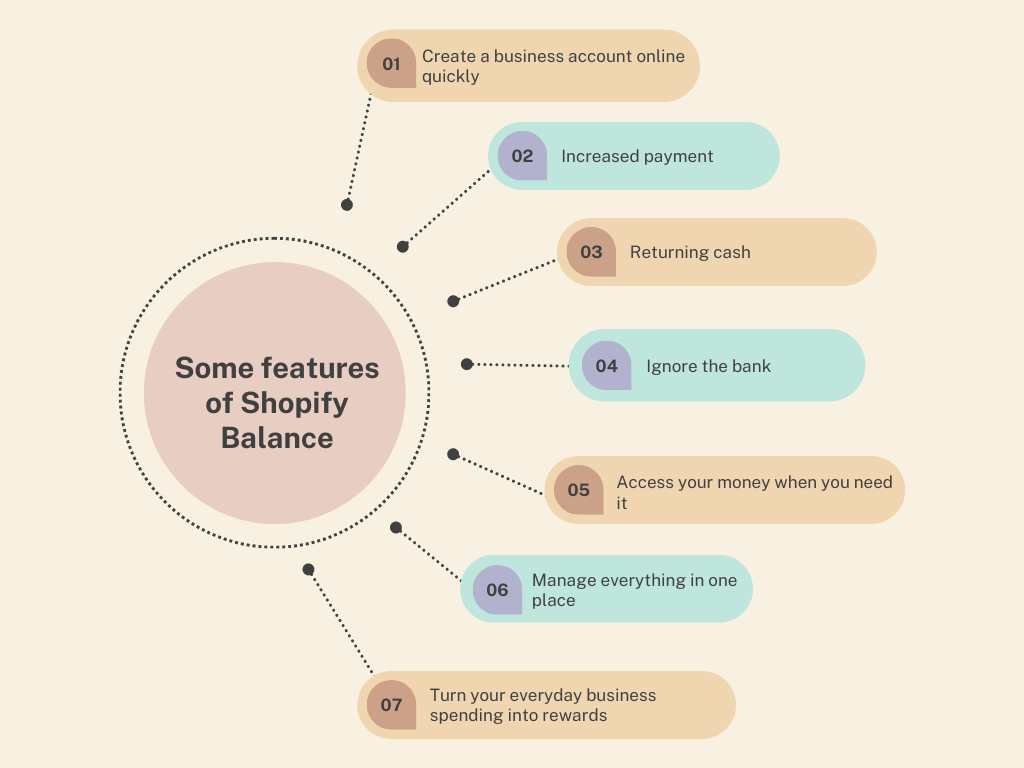

Then we give you some features of Shopify Balance

Create a business account online quickly

Get immediate access to the Shopify-connected, free money management account.

Increased payment

Approach your Shopify store’s earnings in the following business day, up to 4 days sooner than a bank would allow.

Returning cash

Every month, have cash back deposited to your account, and utilize that money to expand your company.

Ignore the bank

Create a free company money management account without entering a bank.

- Reduced paperwork: Create your business account online in a matter of minutes without having to stand in line or complete lengthy forms.

- There are no monthly fees, additional costs, or minimum balance requirements with Shopify Balance.

Access your money when you need it

Use your spending card to make online and in-person business expenditures with the money from your Shopify sales whenever you need it.

- Business spending card: Get a free physical card with your company name on it and instantly receive a virtual card.

- Everywhere Visa is recognized: At hundreds of ATMs across the world, make commercial purchases, settle bills, and withdraw cash.

- Contactless transactions: Touch your phone to make contactless payments after adding your card to your mobile wallet.

Manage everything in one place

Save time by controlling your business and finances in the same location—your store’s administrative area.

- Next business day payments: Up to 4 days sooner than a bank, be paid for your Shopify sales.

- Ordered finances: Keep business and personal costs independently, and always be aware of how well your store is doing.

- Filing taxes simply by a business-specific account, tax season will be easier.

- Transferring money easily: Thanks to linking your preferred financial applications to your Balance account, you can pay bills and transfer money online.

Turn your everyday business spending into rewards

Earn cashback on necessary business purchases to earn rewards, and gain access to exclusive deals.

- Cashback that is automatically added to your account each month when you make eligible business purchases is 2 percent.

- Partner benefits: Take advantage of exclusive deals to keep more of your hard-earned money and reinvest it in your company.

- Expert advice: If you use Shopify Experts to employ consultants, designers, and developers, you will receive a 10% payback.

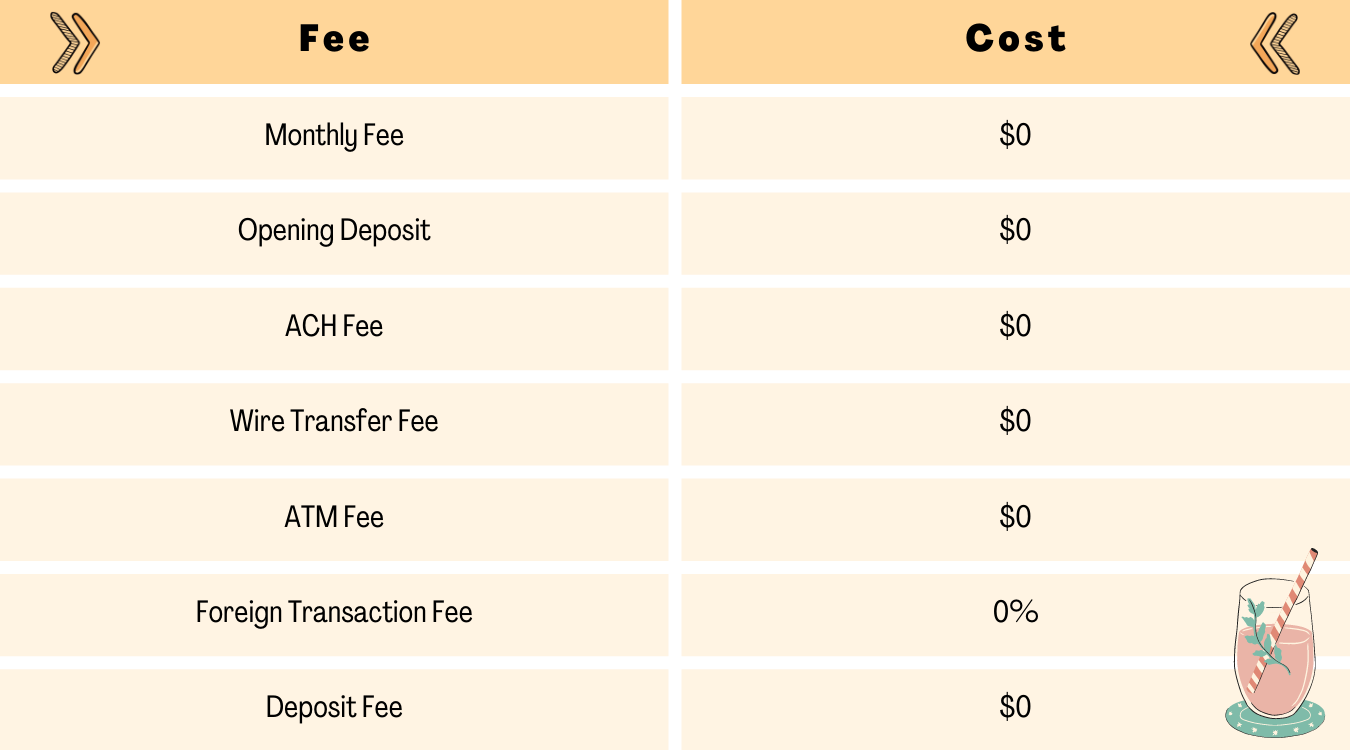

Next, you can take a look about Shopify balance pricing & fees

It might be a cost-effective business banking option because there are no minimum requirements or monthly fees. Additionally, there is no minimum deposit needed to register an account, allowing you to use it as soon as your Shopify business is up and running.

Remember that Shopify Balance is a financial service, not a bank, and that it serves as a tool for managing money rather than as a checking account. Evolve Bank & Trust and Celtic Bank, two FDIC-member banks, support banking. Your money is safe with Shopify Balance even though some traditional banking capabilities, including the ability to deposit cash or create checks, could be lacking.

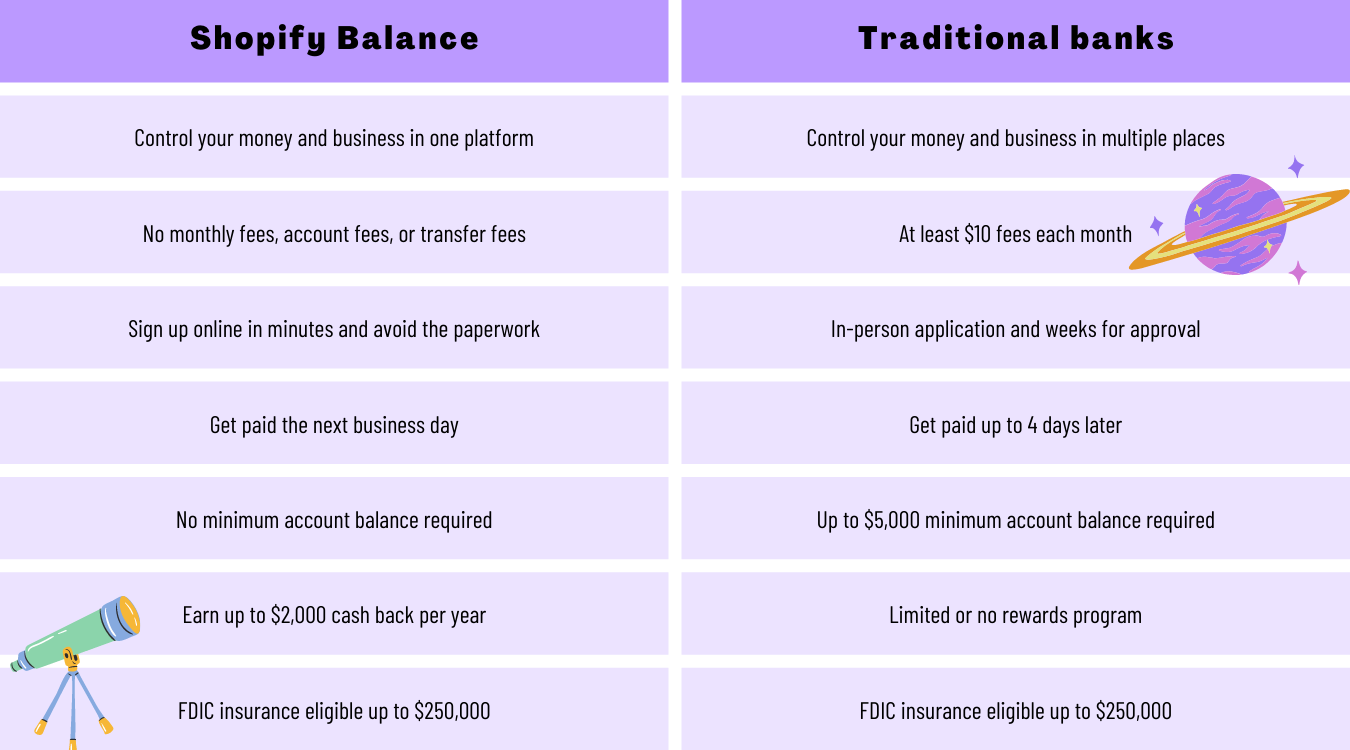

In this part, we’ll compare between Shopify Balance & Traditional Bank

And you can see some Pros and Cons

The positive point

- A quick access to money

- A comprehensive picture of the company’s finances

- One-stop shopping

- Good cashback and rewards

The negative point

- No integrations with accounting

- Only available in the US and Puerto Rico

- Needs a different bank account

- Costly when utilizing Shopify

- Possess a working cell phone number

Then, we give you Setup instructions for your Shopify account

On the Shopify Balance homepage, there are two alternatives for creating an account. Before receiving access to Shopify Balance, start a free Shopify trial and open your online store if you don’t already have one. Log onto your account if you already have one to set up Shopify Balance.

- Log into your Shopify account, then select Finances > Balance from the admin menu.

- Click Open account in step two.

- Click Confirm after reviewing your Shopify payments.

- Add your SSN and mobile number before click Confirm.

- After reading the Shopify Balance Agreement and Shopify Balance Card Agreement, which also includes the privacy policies of financial institution partners, select Open account.

How to access the details of your Shopify Balance account

You may control your account via the Shopify Balance page once you’ve owned a Shopify Balance account.

You can view your account number and routing number by following the instructions below.

- Go to Finances > Balance in your Shopify admin after opening it.

- Select Manage account.

- Select Show information.

Viewing your Shopify balance statements: 3 easy steps

- Navigate to Finances > Balance in the Shopify admin.

- Select View statements on the Account activity card.

- Choose the statement you want to view. A new tab will open with the statement.

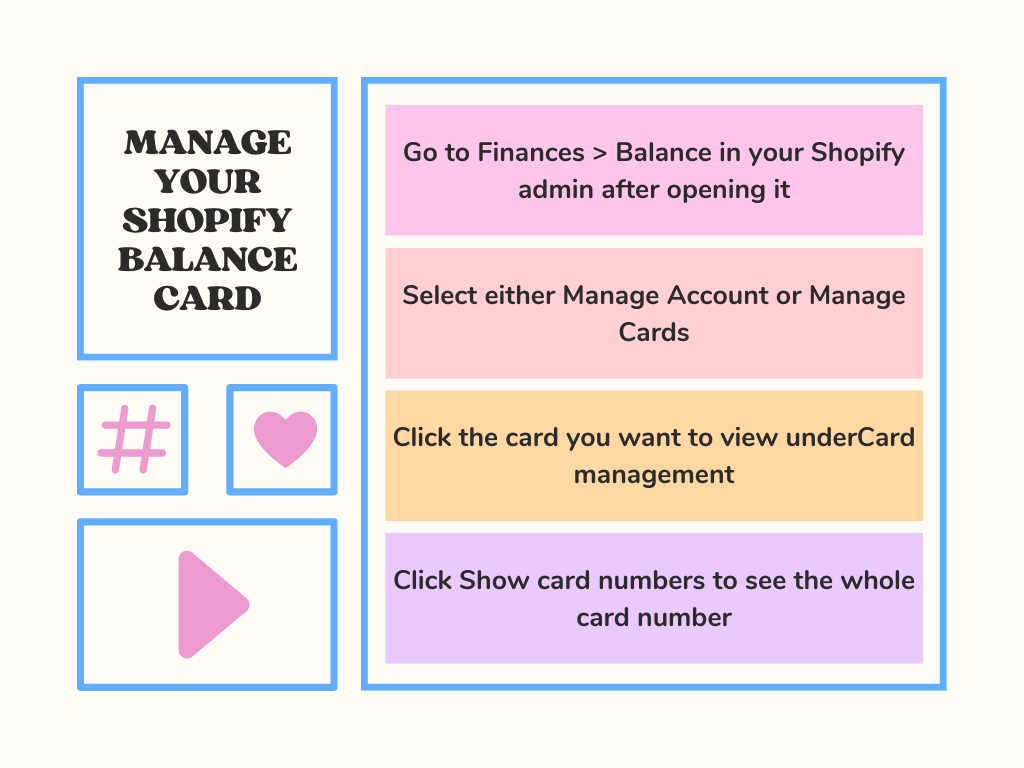

How to manage your Shopify Balance card

From your account page, you can control both your virtual and actual cards. Flowing our step below:

- Go to Finances > Balance in your Shopify admin after opening it.

- Select either Manage Account or Manage Cards.

- Click the card you want to view underCard management.

- Click Show card numbers to see the whole card number.

Conclusion

Through our analytic, we hope you have a certain knowledge about Shopify balance. Although it is a financial service, not a bank, it’s still a helpful assistance to manage your money. With our detailed guide, you can integrate it into your account. However if you aren’t good at this, don’t worry you can contact us to get help from our Shopify development service.

Shopify plus vs Bigcommerce enterprise: The detailed comparison guide